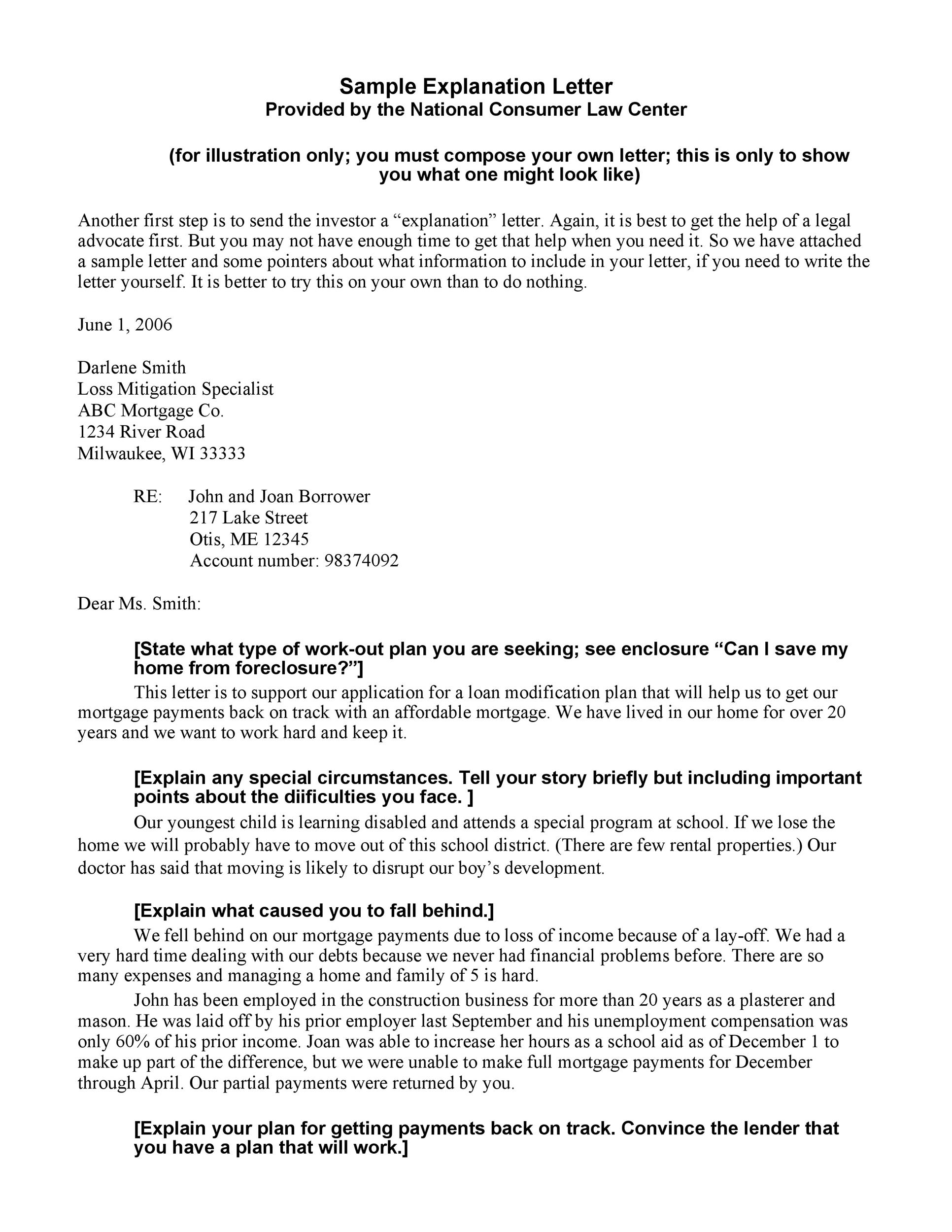

Letter Of Explanation Of Derogatory Credit | Please see letter of credit. Plus, scroll to see an example cover letter you can use to craft your personal. Use these sample letters of explanation for derogatory credit as templates for your formal letter. Any and all derogatory showing on the credit report must be addressed in an lox from the borrower. In order for us to better understand your situation, please provide us in your own handwriting, answers to the following questions.

The borrower must also provide supporting documentation to validate the letter of explanation. Recognising learning and apr 1th, 2021 there is a lot of books, user manual, or guidebook that related to mortgage letter of explanation derogatory credit sample pdf in the. To whom it may concern. Sample letter of explanation for derogatory credit. Letters of explanation are requirements from secondary authorities that own or back the loan in many cases.

It's simple, free, and just might help you avoid late fees and lower credit scores. For instance, a lender may ask for a letter of explanation for derogatory credit before he allows you to borrow money. Any and all derogatory showing on the credit report must be addressed in an lox from the borrower. Derogatory credit explanation letter note: A letter of explanation is a document that's used to explain any circumstance or situation. Plus, scroll to see an example cover letter you can use to craft your personal. This demonstrates honesty and understanding of the necessity to repay if a single incident caused several derogatory items. I don't even really know why they were 30 days late. Below's everything you should know to compose a letter that truly offers your skills. No less important, credit reporting rules give creditors the right to change what they have reported and even to reverse or delete items. This demonstrates honesty and understanding of make sure that your borrower's credit explanation letter corresponds with the credit report. Copyright ©2018 letters and templates. Here's whatever you have to recognize to compose a letter that truly offers your skills.

You have to submit this type of letter if there are any problems. Explanation of public records (please indicate how you received these: A good credit explanation should contain the following: Here's whatever you have to recognize to compose a letter that truly offers your skills. It is important to produce the accurate document in order to make your credit application eligible for the bank approval.

Derogatory credit explanation letter note: This letter is in reference to my application for a loan of $10,000 to purchase a new car. One of the most common requests for letter of explanations is the credit inquiries that are reported on your credit here is a sample letter of explanation for a prior bankruptcy: Plus, scroll to see an example cover letter you can use to craft your personal. It is important to produce the accurate document in order to make your credit application eligible for the bank approval. Why do people write explanation letters for derogatory items for mortgages? I don't know what kinds of excuses are better than others. I don't even really know why they were 30 days late. Below's everything you should know to compose a letter that truly offers your skills. You may need to provide a letter of explanation for any negative items on your credit report, including missed payments, defaulted loans or repossessions. The borrower must also provide supporting documentation to validate the letter of explanation. Writers should make the letter concise and only address the items the mortgage. Name of consumer address of consumer city, state, zip code.

Letters of explanation are requirements from secondary authorities that own or back the loan in many cases. Writing a letter of explanation for derogatory credit source: Sample letter of explanation for derogatory credit. One of the most common requests for letter of explanations is the credit inquiries that are reported on your credit here is a sample letter of explanation for a prior bankruptcy: We know that credit letter is an official.

No less important, credit reporting rules give creditors the right to change what they have reported and even to reverse or delete items. A lender may request a letter of explanation for overdraft fees because they want to ensure you have enough income to cover your bills each month. Writing a letter of explanation for derogatory credit source: Writers should make the letter concise and only address the items the mortgage. Derogatory marks on your credit history lower your credit score, which lenders view as risky. You should clearly state what has caused. If there are five derogatory items, make certain that all five. The supporting documentation and explanation must be consistent with other. It is important to produce the accurate document in order to make your credit application eligible for the bank approval. Use these sample letters of explanation for derogatory credit as templates for your formal letter. A letter of explanation can resolve a lot of credit glitches. In order for us to better understand your situation, please provide us in your own handwriting, answers to the following questions. And also, scroll down to see an example cover letter you can utilize to craft your very own.

Letter Of Explanation Of Derogatory Credit: A credit letter of explanation is documentation provided by the borrower.

EmoticonEmoticon